A key and often critical question most fleet managers ask when considering adopting Electric Vehicles (EVs) into their fleet is: “How does the Total Cost of Ownership (TCO) compare to the gas-powered vehicles I currently use?” The key factors in this comparison are the same for both types of vehicles: upfront cost, lifecycle utilization (months/miles), fuel/energy costs, the cost to maintain and repair, and how much vehicles are worth at the end of their service deployment.

Several key factors for a TCO comparison can be determined with some basic research. However, because many EVs do not have historical data, some factors of the TCO require educated assumptions. With Merchants’ position as an EV leader in the fleet industry, we have had in-depth conversations with our ever-expanding network of ecosystem partners to delve further into these assumptions. These comparisons vary based on the vehicles compared, but we do know that adopting EVs into your fleet will significantly lower your operating costs.

When Ford announced its base price for the commercial-oriented F-150 Lightning at roughly $40,000, a watershed moment occurred. That price is essentially on par with the gasoline version of the F-150 Crew Cab 4×4 (a “like for like” comparison. Not all EVs have reached this level of price parity, with most still being sold at a premium over their ICE counterpart. As an example, the Ford E-Transit 350 carries a premium of approximately $11,000 over the Transit 350 gasoline model with the same options. After factoring in a $7,500 federal tax credit, this cost premium is reduced to $3,500.

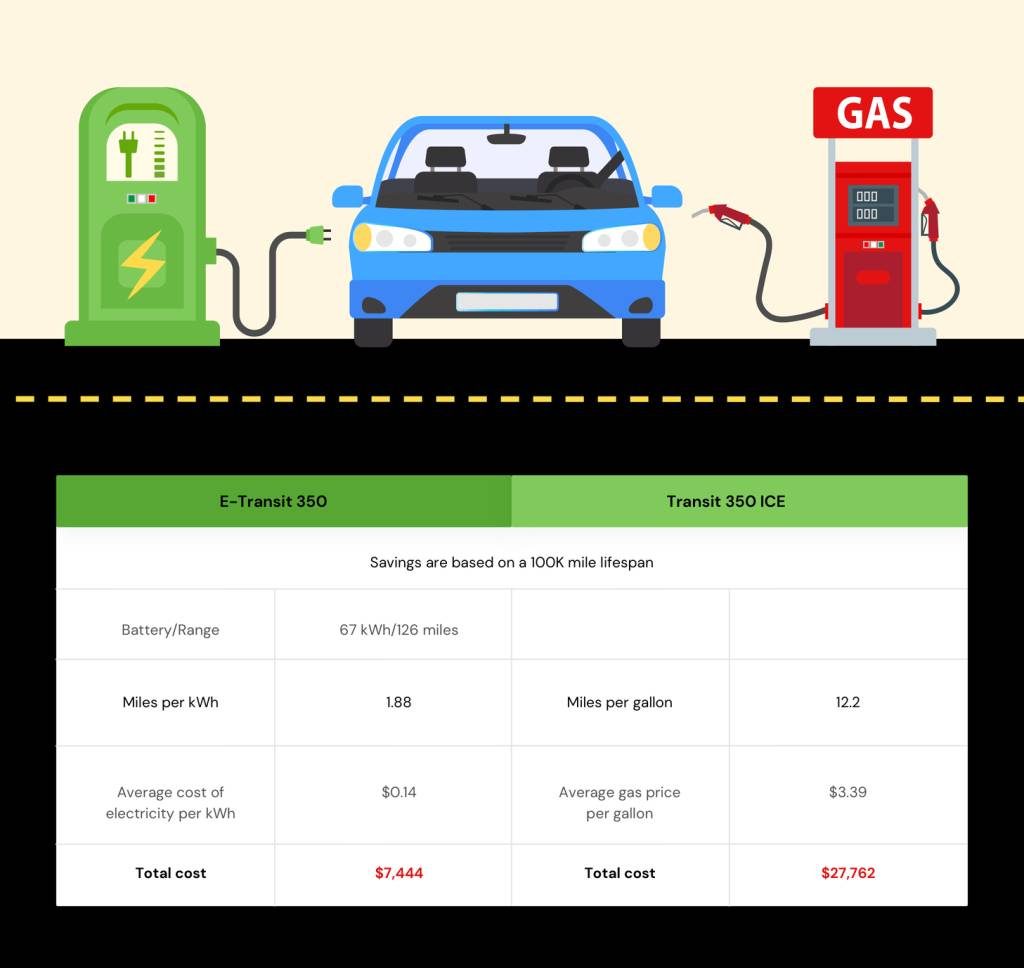

Fuel Breakdown/Cost Per Mile Comparison

A critical element of the total cost of a vehicle is its cost of fuel, or the cost to power the vehicle in the case of an EV. For this comparison, the cargo vans will be driving a total of 100,000 miles over five years.

Maintenance/Repair

Based on Merchants’ database of maintenance and repair spend, those who utilize a gasoline-powered Transit 350 can expect to spend nearly $7,200 on these cost categories over the identified lifecycle. Because there is no historical data available for the E-Transit 350 one must both rely on internal assumptions and external expert advice. For example, we know that the E-Transit will not require oil changes, nor will it have an engine, a transmission, or any belts needing replacement. Its brakes should last longer due to the regenerative effect of the electric motor(s) slowing down the vehicle. Bringing together all that information, the user of an E-Transit 350 should expect to spend about $3,700 on maintenance and repair over five years or 100,000 miles.

Registration Costs

A minor cost that needs to be factored into this comparison is the registration cost difference between an EV and a gasoline-powered vehicle. Many states/municipalities are charging a larger registration tax amount to offset their lost revenue from gasoline taxes charged at the pump. For this comparison, we will assume that cost is $100 per year or $500 in total over five years. (Yes, even in locations where jurisdictions are offering incentives for electric vehicles, they may charge an additional amount for registering those same vehicles).

EV Rebates and Incentives

In addition to the costs outlined above, other things to consider would be parking discounts for EVs, free-charging options, on-site charging infrastructure costs, State & Regional incentives for both the vehicle and infrastructure, efficiency gains due to qualification for Carpool and HOV lanes in congested areas, etc. and most importantly, the positive impact on the environment of an EV versus an ICE vehicle.

End of Lifecycle Comparison

The last factor to consider for a TCO comparison is what these vans will be worth at the end of their five-year or 100,000-mile lifecycle. As a new entrant into the marketplace with model year 2022, there is no data available to make an accurate forecast of expected resale value for an E-Transit 350. If we look to the sedan market, vehicles like the Chevrolet Bolt and Nissan Leaf retain less of their value than do comparable gasoline-powered compact sedans. Other vehicles like the Tesla Model 3 retain more of their value. Mixed datapoints make it difficult to pinpoint exactly what the expected value should be.

There are several factors that could lead to a conclusion that an EV will soon begin to retain more of its value than an ICE vehicle. For example, future demand for vocational electric vehicles is expected to far exceed supply as more companies become purpose-driven and strive to improve their ESG performance. With that in mind, we assume the two vehicles will sell for the same amount at the end of their lifecycle. According to Blackbook, the gasoline-powered Transit 350 is expected to retain 26% of its value at our targeted lifecycle. By assigning that same dollar value from the gasoline-powered Transit to the EV, we assume the more expensive EV depreciated more quickly than the gas-powered Transit.

Cost Analysis (Five-Year)

Bringing together the data points above, we can build a TCO estimate for both vehicles. Before any incentives, we expect the E-Transit 350 to have a TCO of just over $6,000 more than the gasoline Transit 350 over a five-year or 100,000-mile lifecycle:

Ford E-Transit 350: $46,882

Ford Transit 350: $40,857

For those able to utilize the Federal Tax incentive of $7,500 with the EV, the E-Transit comes in with a lower TCO by about $1,500:

Ford E-Transit 350: $39,382

Ford Transit 350: $40,857

As an industry leader, Merchants Fleet recommends electrifying your fleet. We can assist with your EV purchases and help improve your fleet operations and productivity. Contact us today to get started.